How blockchain technology is revolutionizing KYC processes

New technologies are also influencing the area of regulation including money laundering prevention, especially know-your-customer (KYC) verification. According to experts, the area of money laundering prevention will be massively changed, especially by blockchain technology as well as artificial intelligence. Various feasibility studies have already been published on this. In part, these technologies are already being used in practice and enable a more efficient design of KYC checks.

In some countries, the use of blockchain technology for KYC verification is already well advanced. CURENTIS looks at the start of development and the status in the United Arab Emirates, Singapore and Luxembourg.

Back in 2017, Moyano & Ross published their study, "KYC Optimization Using Distributed Ledger Technology," which laid the foundation for further analysis and study in the area of KYC due diligence through the use of blockchain technology.

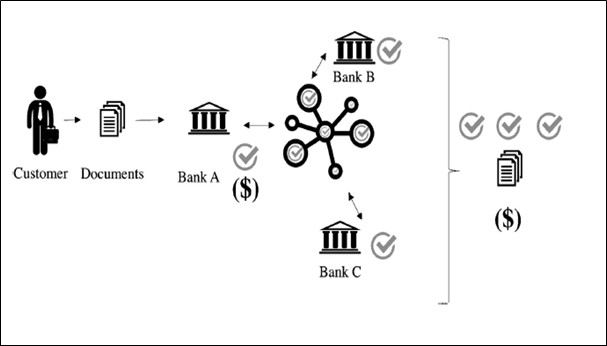

In the blockchain-based concept, the KYC process is performed exactly once for a customer. In this model approach, it is irrelevant with how many banks the customer maintains a business relationship. Data is collected periodically, depending on the risk classification, and shared within the blockchain with the relevant financial institutions. In this case, the KYC verification is done through a so-called "trusted third party", an organization specialized in the field of KYC, which acts independently and is licensed and certified by government authorities. Banks that have a legitimate interest in KYC documentation acquire the information collected by the trusted third party. Through this, KYC costs are shared by the parties involved in the private blockchain. Further, far-reaching understanding about the customer is created, the risk associated with the customer is adequately identified, and trust is gained by the authorities.

Figure 1: How blockchain works between banks (Moyano & Ross.2017).

Therefore, this approach not only improves banks' compliance with the rules, but also saves significant costs and improves the customer experience. Therefore, it is worth noting: Financial institutions that invest in and implement this technology early will gain a significant competitive advantage over competitors.

The potential of the blockchain concept was recognized early on in the United Arab Emirates (UAE). As early as February 2020, Dubai's Departent of Economic Development launched the initiative of a blockchain consortium. A private blockchain for KYC data shared by the members of this blockchain. The motivation behind this initiative is to create a national ecosystem for KYC data that spans financial institutions, licensing authorities, and the legislature. Thus, obligated parties and regulators would work together to advance anti-money laundering efforts. The founding members of this initiative are the most significant market players in the Arab financial industry. These include: Dubai International Financial Centre, Emirates NBD, Emirates Islamic, Commercial Bank of Dubai, HSBC, Abu Dhabi Commercial Bank, RAKBANK and Mashreq Bank.

The disruptive potential of this technology in relation to KYC has also been recognized in Singapore. An initial prototype by OCBC Bank, HSBC, Mitsubishi UFJ Financial Group and Infocomm Media Development Authority tested the functionality of blockchain technology in the KYC verification use case. The goal was to avoid multiple KYC verification of customers. The results of this prototype are also promising in Singapore: significant cost savings and an improved customer experience will be the consequences of this initiative.

In Europe, on the other hand, there is as yet no Europe-wide or government support for such a project. Nevertheless, a startup called I-hub was founded in 2016, which also takes the approach of multiple use of KYC data. The business model focuses on collecting KYC data from various companies and individuals, and sharing this information within a specific banking group. This data is stored in a wide-ranging database, which is designed to meet the highest security standards. I-hub, which acts as a trusted third party within the consortium, has already obtained relevant licenses from the Luxembourg Ministry of Finance. With this project, they were able to win over market-defining partners. These include Banque Luxembourg, Spuerkess, Banque internationale a Luxembourg, BGL BNP Paribas and Post Luxembourg.

This venture, which is reminiscent of the approaches of the Dubai and Singapore consortia, differs in its use of technology. Dubai and Singapore are committed to blockchain, whereas I-Hub's approach is based on traditional data storage. As a result, the I-Hub approach does not fully exploit the potential of current technological capabilities from the CURENTIS perspective.