How far does the transparency of transparency registers extend worldwide?

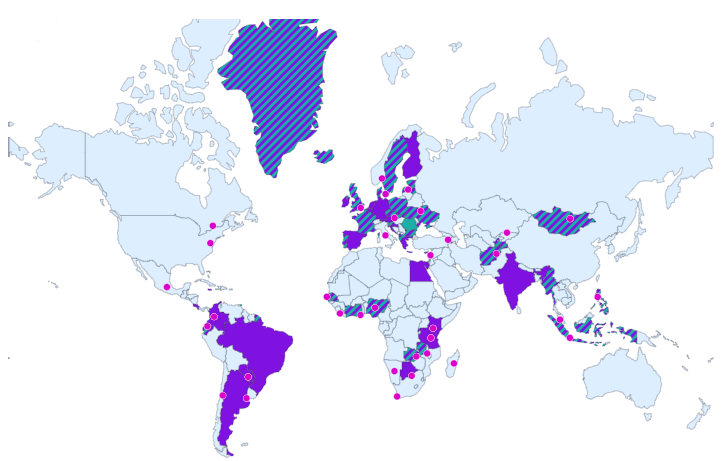

Public transparency registers on the ultimate beneficial owners of companies are an extremely important anti-money laundering tool. Unfortunately, they are still insufficiently widespread worldwide, which severely hampers efforts to combat money laundering and illicit financial flows. Out of 195 countries worldwide, only 58 (including 24 EU countries) have implemented transparency registers so far, although 129 countries have publicly committed to their introduction.

Also striking, and in some cases very surprising, are those countries that have not set up any register at all - neither centrally nor publicly - including the USA, Canada, Japan, Australia, Italy and Norway. On the other hand, there are countries such as Indonesia and Paraguay that provide a publicly accessible register of the entire economy (not just of selected sectors). Many countries also rely on mixed forms (shown in dashed lines in the graph below), where a central register exists and parts of it are publicly accessible, e.g. selected sectors of the economy.

Source: "The Open Ownership Map," states with implemented BOT registry, a work of Open Ownership, licensed under Creative Commons Attribution 4.0 International, https://creativecommons.org/licenses/by/4.0/, No modifications included.

In general, the effectiveness of transparency registers depends on a variety of factors and is limited by the following challenges, among others:

- More centralized than public registers

There are considerable differences in implementation - some countries rely on purely centralized rather than public registers in the interests of data protection, which are either difficult for natural persons to access or are generally only accessible to certain authorities or organizations. Of a total of 58 implemented registries worldwide, only 34 are publicly accessible. - Lack of international cooperation

Transparency often ends at national borders due to the lack of international cooperation and standardized information exchange protocols. - Lack of data quality

The quality of the data collected also varies considerably from country to country, which has affected the comparability and effectiveness of the registers. Whether states collect only basic beneficial ownership data or provide detailed information varies, sometimes significantly. While there are efforts to promote certain standards and best practices for the establishment and management of these registries (e.g., by the FATF), each must be applied to the existing legal system and legislative situation.

The mere existence of a register is therefore no guarantee for an improved fight against money laundering if they hardly hold any relevant data and/or are only accessible to certain circles or after an often lengthy, sometimes cost-intensive, bureaucratic process. In this context, the question arises as to how transparent a transparency register must at least be in order to be of any use in the fight against money laundering.

In Germany, unrestricted public access to the transparency register has been declared invalid following the ECJ ruling of November 22, 2022. Inspection is now only permissible via a formal request for inspection in which a justified, legitimate interest is asserted by the persons concerned.

Overall, international enforcement of transparency registers is sobering. Much still needs to be done to foster cooperation among governments, international organizations, and the private sector to effectively establish and maintain these registers.

Switzerland is currently discussing the introduction of a central transparency register. CURENTIS will report shortly on the status of the discussion.