EBA Pillar 3 ITS - the new ESG reporting

With the technical standards on ESG reporting, which were published on January 24, 2022, the EBA sets binding requirements for disclosure obligations regarding risks that may arise from changes in the area of environmental, social and governance.

The guideline will result in financial institutions having to publish uniform and, above all, comparable data regarding ESG-related risks. As a result, it will take less effort for investors and interested parties to assess the sustainability performance of individual financial institutions. In addition, companies can demonstrate how they are driving and supporting the transformation to a more sustainable economy. Both quantitative and qualitative factors are taken into account.

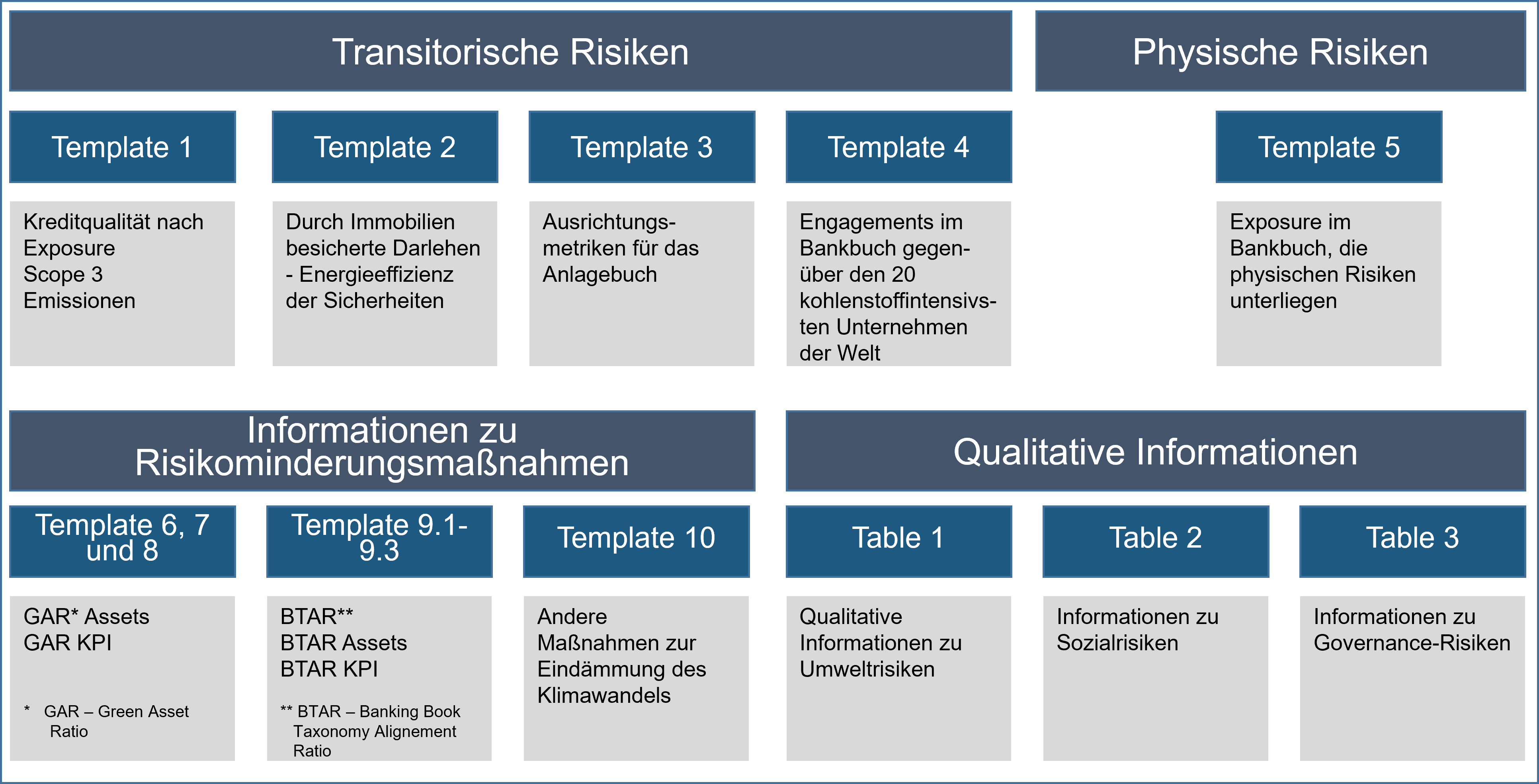

In total, the EBA published 10 templates and three tables with data on ESG-related events. These contain a wide range of information to highlight the transitory as well as physical issues to which financial institutions are exposed. Transitory risks are defined by the EBA as the risk of losses due to negative financial impacts on the institution resulting from the current or future consequences of the transition to an environmentally sustainable economy on its business partners or invested assets. In particular, these result from the transformation to a low-carbon and climate-resilient environment. Physical risks can stem primarily from natural events.

In particular, the following key topics are highlighted in the templates:

- Credit quality of sectors that contribute to climate change to a greater extent or are carbon intensive. This includes data on non-performing loans, provisions and related impairments.

- Information on Scope 3-, which arise along the value chain, must be published in the period up to June 2024 (full requirement).

- Scope 1: Direct emissions generated e.g. by company cars

- Scope 2: Indirect emissions produced from the consumption of electricity, water, etc.

- Scope 3: CO2 emissions that occur upstream during purchasing or downstream at the customer's site.

- Energy efficiency of collateral and real estate acquired through repossession

- Information on scope 3 emissions in relation to the sectors of the business partners. If this information is estimated, explanations on the calculation and origin of the data used must be provided.

- Disclosure in accordance with the Paris Agreement

- Bank's exposure to the world's 20 most carbon-intensive companies

- Exposure to physical risks

- Green Asset Ratio (GAR) and Banking Book Taxonomy Alignment Ratio ()

- The green asset ratio shows the proportion of a bank's loans and securities that comply with the EU taxonomy in relation to total assets in the banking book

- The BTAR is intended to show the share of taxonomy-relevant exposures to companies that do not fall within the scope of the NFRD

- Qualitative information on ESG

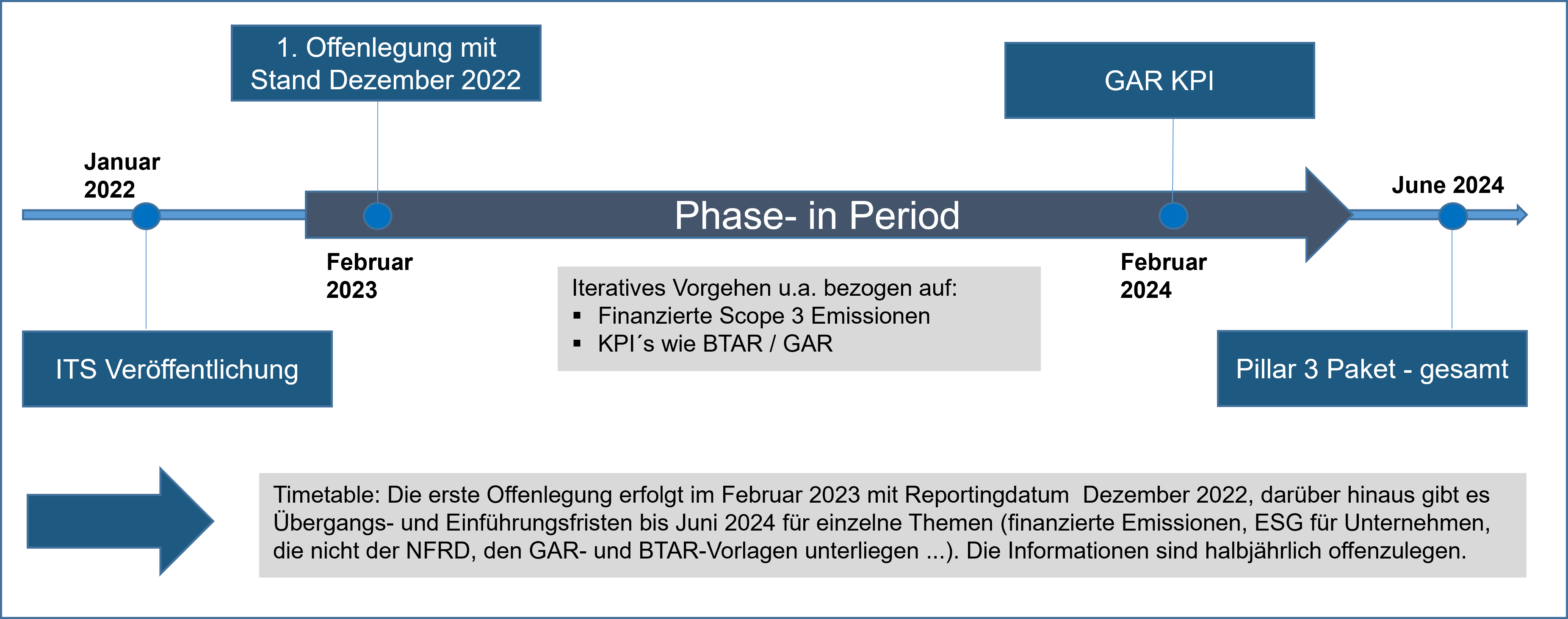

Supervision gives financial institutions until June 2024 to implement all requirements. However, the first disclosure requirements must already be met in February 2023. This will be followed by a phase-in period, so that the full data must be published on a half-yearly basis from June 2024.

The topic of ESG is increasingly becoming the focus of supervision and entails far-reaching requirements and implementation measures by financial institutions. As a specialist for regulatory requirements, we support you in determining the need for action (GAP analysis), defining and implementing necessary information and KPIs, and preparing templates and reports.

The entire document can be found at: https://www.eba.europa.eu/eba-publishes-binding-standards-pillar-3-disclosures-esg-risks