WHY THE SPECIAL ASSETS OF THE FEDERAL GOVERNMENT HAVE AN IMPACT ON THE CREDIT DEFAULT RISK!

The German Federal Financial Supervisory Authority (BaFin) considers the correction on the real estate markets to be one of the top risks for 2025. The agreed special fund and the relaxation of the debt brake could lead to significant loan defaults in the real estate sector.

Special funds and the relaxation of the debt brake will result in a massive increase in national debt.

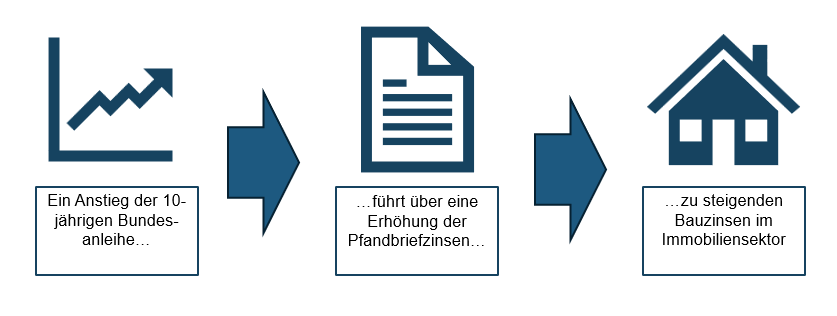

The announcement of these considerations alone caused the yield on 10-year German government bonds to rise from below 2.50% to 2.93%, the sharpest increase since reunification. In addition to a higher interest burden and rising inflation, 10-year Bunds have a significant impact on interest costs in the real estate sector.

Financial institutions use Pfandbriefe to refinance their construction financing business, the interest costs of which are based on German government bonds. Building interest rates are based on the Pfandbrief interest rate plus a risk premium. The federal bonds therefore have an influence on the building interest rates via the Pfandbrief interest rate.

However, an increase in construction interest rates poses a significant credit default risk for financial institutions. The follow-up financing of property loans in particular is risky due to rising construction interest rates, as borrowers may no longer be able to afford such follow-up financing. According to BaFin, more than half of the volume of current loans had interest rates of less than 3% at the end of 2024. In 2025 and 2026, follow-up financing for commercial real estate loans worth 100 billion euros will have to be renegotiated. This sum corresponds to around one tenth of the total loan volume in the commercial real estate sector.

Loans also represent a risk for project developers, as they have to make advance payments on their investments. Negative factors such as high interest rates lead to a drop in demand for properties or projects not being implemented at all. This can lead to lower returns on the investment or difficulties in repaying the loan. For the banks, this significantly increases the risk of loan defaults.

As an expert in risk management, CURENTIS AG works with you to examine the impact on your real estate loan portfolio and develops targeted measures to assess the credit default risk and prevent loan defaults.