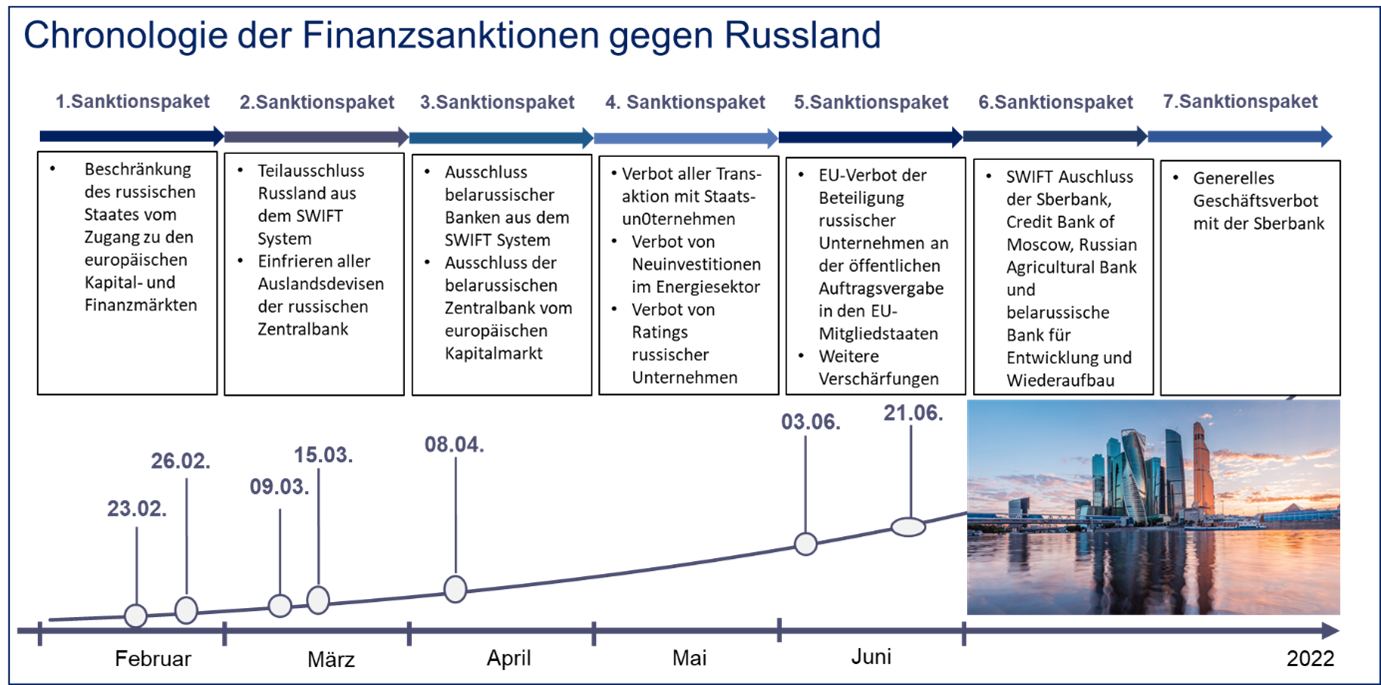

Chronology of EU sanctions against Russia

Against the backdrop of the Russian attack on Ukraine and the resulting sanctions imposed by America, the EU and Switzerland, the hoped-for effects and undesirable side effects of sanctions are a very topical issue. As part of our series of articles on this topic, in this article CURENTIS describes the EU sanctions packages against Russia adopted so far and ranks their effectiveness.

The EU has published 7 sanctions packages to date. These packages provide for sanctions against specific sectors of the economy, individuals, organizations, as well as companies and banks.

This article focuses on the sanctions against banks and financial sanctions against countries and organizations. These are shown in the overview below.

1st sanctions package (23.02.2022)

On February 23, 2022, EU sanctions in the wake of the Ukraine war were published in an EU Official Journal for the first time. The Official Journal contained individual sanctions, economic sanctions and restrictions on financial markets.

From the perspective of banks and financial markets, the following sanctions were momentous:

Restrictions on the ability of the Russian state and government to access EU capital and financial markets and services. This primarily affects Russian government bonds in order to make it more difficult for the Russian government to refinance itself.

Russian government bonds may not be purchased or traded by any European citizen or institution as of now.

The general economic sanctions against Russia and the areas no longer controlled by Ukraine in the war region also have an impact on European banks. European banks with Russian corporate customers have to cancel these transactions and often write them off as losses.

In addition, corporate clients that have strong business ties to Russia will have to be reassessed in terms of risk. As a result, even such customers may no longer be viable for their principal bank.

2nd sanctions package (26.02.2022)

The EU Commission decided on February 26, 2022, just three days after the first sanctions package, to impose further sanctions in cooperation with the United States, France, Canada, Italy, the United Kingdom, and Germany.

The second sanctions package is significantly more far-reaching for the banking world and financial markets than the first. Its catalog of measures includes the following sanctions and regulations:

A partial exclusion of Russia from the SWIFT international payment services system, which Switzerland has also joined. This exclusion includes so many Russian banks that 70% of the Russian banking market is affected. The excluded banks are mainly those institutions that process many transactions abroad via SWIFT. The remaining 30% of banks are mainly local banks that do little to no transfers via SWIFT.

Three types of banks were excluded from the SWIFT exclusion:

- Banks required for the processing of payments for energy deliveries

- Banks important for the payment of Russian debts

- banks whose European partner credit institutions might otherwise run into serious financial difficulties.

In addition, the EU sanctioned the Central Bank of the Russian Federation itself. This meant the freezing of all assets of the Russian state bank. These are primarily foreign currency reserves and gold. In total, the Russian State Bank has deposited $630 billion in foreign currency equivalent. Most of this reserve can now no longer be called up.

Due to the second sanctions package, the ruble experienced a downward slide. At the beginning of January, one EURO was worth 85 Russian rubles, and by mid-March it was already 144. In the meantime, however, the ruble exchange rate has recovered. However, this swing shows that the sanctions have had an impact on the ruble.

3rd sanctions package (09.03.2022)

The third sanctions package of 09 March 2022 has an impact on Belarus for the first time:

With this sanctions package, the financial sanctions against Russia will also be applied to Belarus. This means:

- Exclusion from the SWIFT network of Belagroprombank, Bank Dabrabyt and the Development Bank of the Republic of Belarus and their Belarusian subsidiaries.

- Prohibitions on transactions with the Central Bank of Belarus related to the management of reserves or assets and the provision of public financing for trade with and investment in Belarus.

- As of April 12, 2022, the listing and provision of services related to shares of Belarusian state-owned companies on EU trading venues is prohibited.

- Ban on the supply of euro-denominated banknotes to Belarus.

The Belarusian ruble also experienced a slump after the third sanctions package, from which it has since recovered. The Belarusian ruble had been falling since the beginning of the war before rising again to pre-war levels in mid-2022.

4th sanctions package (15.03.2022)

In the fourth sanctions package, the EU agrees on new sanctions in the areas of energy, finance and credit rating services. There are also new trade restrictions.

In detail, the Council decided on the following measures:

- A complete ban on any transactions with certain Russian state-owned enterprises in various sectors of the Kremlin's military-industrial complex. This includes companies whose beneficial owner is or is controlled by such a Russian state-owned enterprise. For many European companies with a stake in such Russian state-owned enterprises, this means the cessation of economic activity, as the company will no longer be able to make or receive transfers.

- A far-reaching ban on new investments in the entire Russian energy sector, with limited exceptions for civil nuclear energy and the transport of certain energy products back to the EU.

New investments by banks, especially in investment banking, must therefore be scrutinized even more closely for Russian involvement. - Russia itself and Russian companies may no longer be rated by EU rating agencies. The provision of a rating service for Russian companies is also prohibited.

For listed stock corporations, ratings are important to convince potential investors of the quality of the company. Without ratings, less will be invested.

In addition to the restrictions on investments in companies with Russian participation and energy companies, the EU is passively restricting the entire Russian stock market by banning ratings on Russian companies. An investor or investor from Europe will not invest in Russian companies without appropriate ratings, as the risk of default on the investment is too great.

5th sanctions package (08.04.2022)

To close loopholes, the fifth sanctions package established the following rules:

- A general EU ban on the involvement of Russian companies in public procurement in EU member states. I.e. if EU funds are used as an investment, no Russian company may be directly or indirectly involved in awarding the contracts.

- The exclusion of financial support of Russian, public institutions.

- An extended ban on deposits to Russia and Belarus. This means that no more cash may be deposited into Russian or Belarusian accounts. This also applies to accounts of Russian companies as well as Russian crypto wallets

- The sale of securities denominated in EURO to Russian and Belarusian legal entities is prohibited.

- Four other Russian banks, representing 23% of the market share in the Russian banking sector, will be excluded from the SWIFT system. Among others, one of the largest Russian banks, VTB Bank, is affected. Prior to this sanctions package, these banks were not included because they fell under the exemptions in the 2nd sanctions package.

6th sanctions package (03.06.2022)

Russia's largest bank Sberbank fell under the special regime of the second sanctions package until the 6th sanctions package. Now, together with Credit Bank of Moscow, Russian Agricultural Bank and Belarusian Bank for Development and Reconstruction, it is excluded from the SWIFT system.

This means that almost the entire Russian banking system is excluded from the SWIFT network.

CURENTIS reported on this issue in the past https://curentis.com/allgemein/update-ukraine-krise-was-bedeutet-der-teilausschluss-russischer-banken-aus-dem-swiftnet-fuer-deutschland/

7th sanctions package (21.06.2022)

The 7th sanctions package goes one step further with regard to Sberbank and places it under a general ban on doing business with the EU. This is a big step for the EU, as it is the first general ban on a Russian bank doing business in the EU.

As big as the cut is for the EU sanctions policy, the impact on Sberbank will probably be minor, because the U.S. had already put Russia's largest financial institution on the sanctions list at the beginning of April.

Since then, EU and U.S. banks' business with Sberbank has been almost non-existent anyway.

The European subsidiary of Sberbank, which is based in Austria, had already had to cease its business activities in March. However, the institution was able to avert insolvency and is now being wound up in an orderly manner. By selling loan receivables, the bank could fully repay the sum of 926 million euros paid out to customers by the Austrian Deposit Guarantee Scheme (ESA).

Conclusion

The 7 EU sanctions packages include not only financial sector sanctions, but many more individual and economic sanctions. Never before has the EU enacted such a comprehensive catalog of sanctions against a country.

Sanctions such as the partial exclusion from the SWIFT system, the investment ban in certain industries, as well as the general business ban on Russia's Sberbank are sanctions that have never before been adopted in consequence at the EU level.

However, the latest sanctions package against Sberbank shows that the U.S. implements sanctions much faster and more consistently. The EU's general business ban is unlikely to have much effect on Sberbank 3 months after the business ban from the US.

The short-term effectiveness of the EU sanctions in the financial sector is particularly evident in the development of the ruble. Restrictions at the level of state banks may continue to hit the Russian state hard. However, the Russian state was able to stabilize the exchange rate of its own currency again through countermeasures. How often the Russian state will succeed in doing so in the future remains questionable. In addition, the Russian state will have to provide enormous financial aid in order to implement the countermeasures.

A long-term development brought about by the EU sanctions is the acceleration of inflation in Russia. In particular, the more difficult trading conditions due to the SWIFT exclusion and the investment ban on Russian companies will have a major impact in the long term from a financial policy perspective.