Realignment of the regulatory reporting system - BaFin informs about feasibility study

In a feasibility study, the German Federal Financial Supervisory Authority (BaFin) presents perspectives for the realignment of the regulatory reporting system. Together with BaFin, the Deutsche Bundesbank and the banking industry have developed a target picture that simplifies the implementation of reporting requirements for institutions. BaFin itself could benefit from significantly improved analysis capabilities and react more quickly to developments. The aim of the feasibility study was to develop approaches to solutions for improving the analysis capability of the supervisory authority while at the same time reducing the workload of the institutions and to test them in prototype form with pilot banks and data centers. In doing so, the participants took into account current European initiatives on data reporting such as the "Eurosystem Integrated Reporting Framework" (IReF), the "Banks Integrated Reporting Dictionary" (BIRD) and the feasibility study on integrated reporting by the European Banking Authority (EBA).

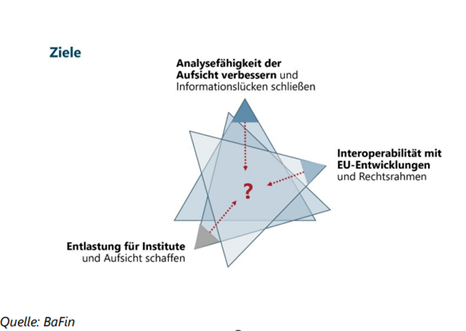

The result is clear: The regulatory reporting system must be realigned quickly. The target picture is based on a mixed-granular data model that could apply uniformly to all reporting requirements in the future (see figure). This means that in addition to granular data, the model also includes aggregated data points that are not mapped granularly. As a result, data that can be mapped granularly would only be included once in the data model and the model could map different aggregate forms. A further building block of the target image is a machine-readable set of rules for data quality checks and data point aggregations based on the model. This "digital foundation" should be created at EU level and ideally in cooperation with the banking industry. In this way, the implementation of the IReF advised for 2024 to 2027 could be used as the first expansion stage (minimum viable product) for the target image developed in the feasibility study. In order to realize its full potential, the current legal framework would have to be adapted and the European initiatives would have to agree on a common target picture and data model. The Joint Reporting Committee (JRC) announced by the EBA could lay the foundation for this. BIRD also brings a lot of prerequisites for the data model to be developed. You can read the detailed study here.