Environmental and climate risks: The glass is not (yet) half-full

Yesterday, the ECB published a thematic audit report on environmental and climate risks and gave banks a tight schedule for dealing with climate risks. The findings of the audit report show that many banks are still in their infancy when it comes to dealing with environmental and climate risks. Although, in contrast to 2021, many of the credit institutions examined have addressed environmental risks, in most cases a rough categorization of the exposure has been carried out, responsibilities within the institution have been named and mitigation measures for parts of the portfolio have been analyzed. However, these efforts lacked methodological sophistication, granular risk information and active portfolio management.

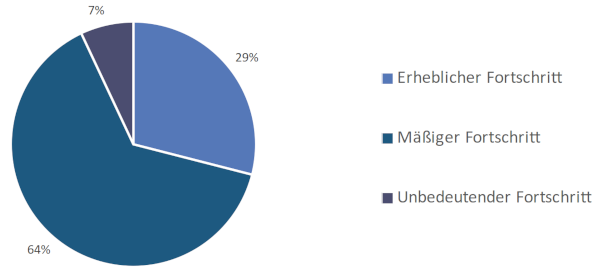

In more than 96% of the cases examined, there was a lack of a fully comprehensive risk assessment with regard to climate and environmental risks. The first steps have been taken, but the ECB still sees a great need for action to meet the targets set out in the ECB Guide on climate-related and environmental risk published in 2020. Although 93% of banks have made progress since the last assessment last year, this progress has been limited and not substantial enough to meet regulatory expectations. Chart 1 shows the percentage of banks by their progress against the Action Plan 2021:

Consequently, the ECB has come to the conclusion that about half of the credit institutions cannot demonstrate any significant progress with regard to climate and environmental risks.

For this reason, the ECB has made the following milestones mandatory with the publication of the thematic review report:

- End of March 2023: Credit institutions must have categorized their climate as well as environmental risks and assessed what impact these have on banking activities

- End 2023: Climate and environmental risks must be included in governance, strategy and risk management

- End 2024: Full compliance with the ECB Guide on climate-related and environmental risk published in 2020.

With the publication of the thematic review report on climate and environmental risks at credit institutions, the ECB has tightened its course. There is now a clear timeframe by which credit institutions must have assessed and implemented these risks. The timetable is tightly set and requires immediate action.

CURENTIS AG supports them in complying with the regulatory requirements as well as the set deadlines.

Source: Walking the talk - Banks gearing up to manage risks from climate change (europa.eu)

About the author: Artur Kehrein has been a senior consultant at CURENTIS AG since 2022. In the course of his many years of work in financial institutions and in consulting, he has been able to build up extensive project experience. In addition, he has specialized in regulatory reporting and sustainable finance.