What role does the German Sustainability Code play in the banking industry?

What is the German Sustainability Code?

In 2011, the German Sustainability Code (DNK) was adopted by the German Council for Sustainable Development. The Council is a body that advises the German government on sustainability issues. It is convened by the Federal Chancellor for a three-year term and is composed of representatives from various disciplines. The Sustainability Code defines a uniform framework for reports on the sustainable orientation of a company. It can be applied by companies and organizations of all sizes, both nationally and internationally. Since the code was published in 2011, it has also entered the banking industry. CURENTIS used a random sample to examine the extent to which banks submit reports in the German Sustainability Code and how up-to-date they are.

Reporting periods and scope

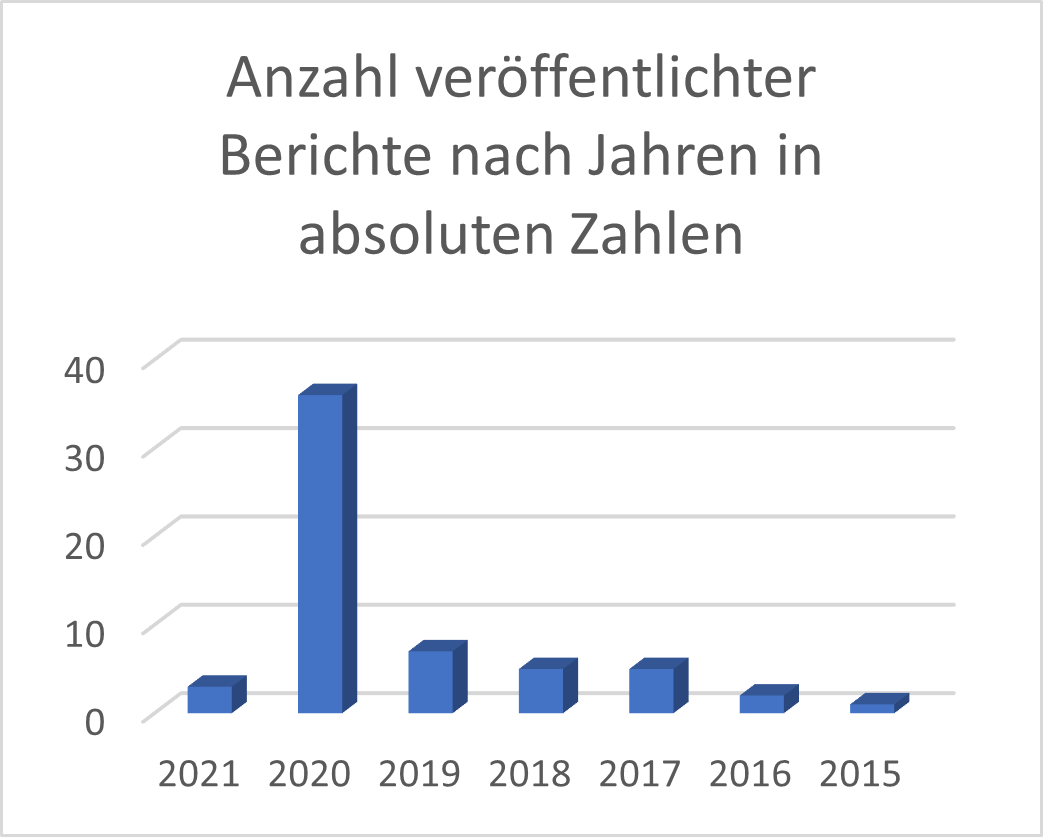

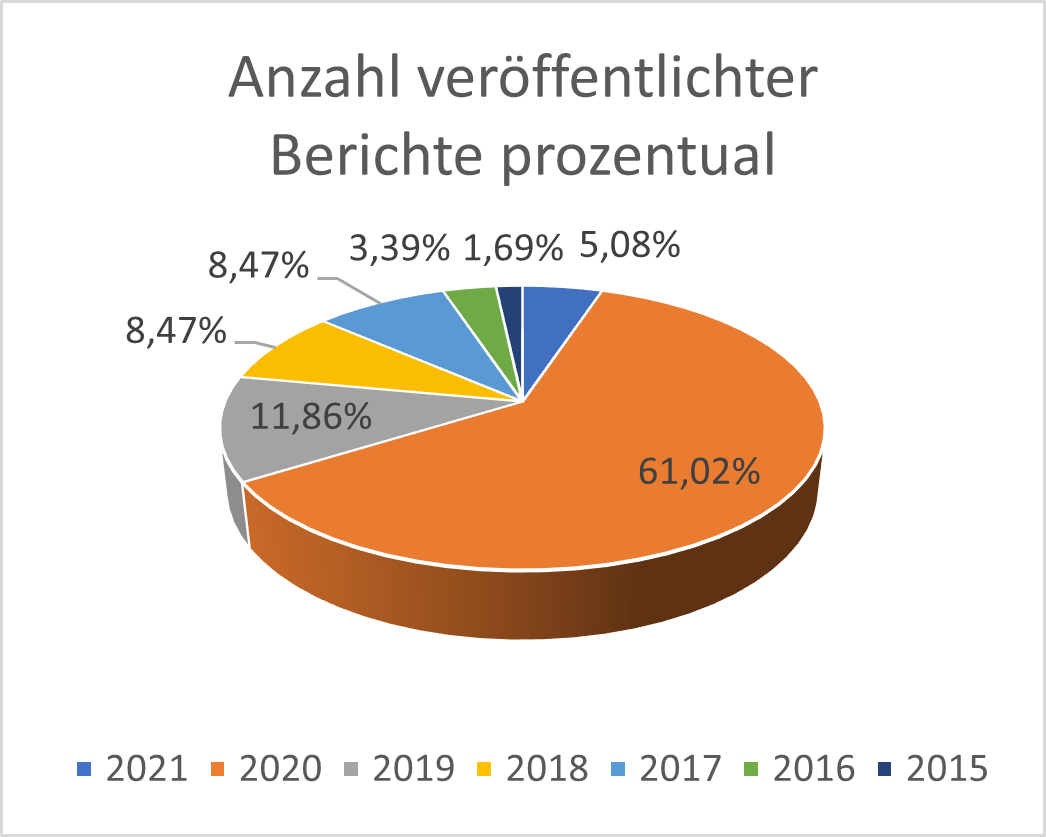

In the following, 59 banks are considered, all of which have published a report in the sense of the DKN (as of 2021). There are differences in when and how often such a report was published. As the two figures below show, 66% of the banks have published a report within the last two years. For others, the most recent report dates from earlier years, the oldest from 2015.

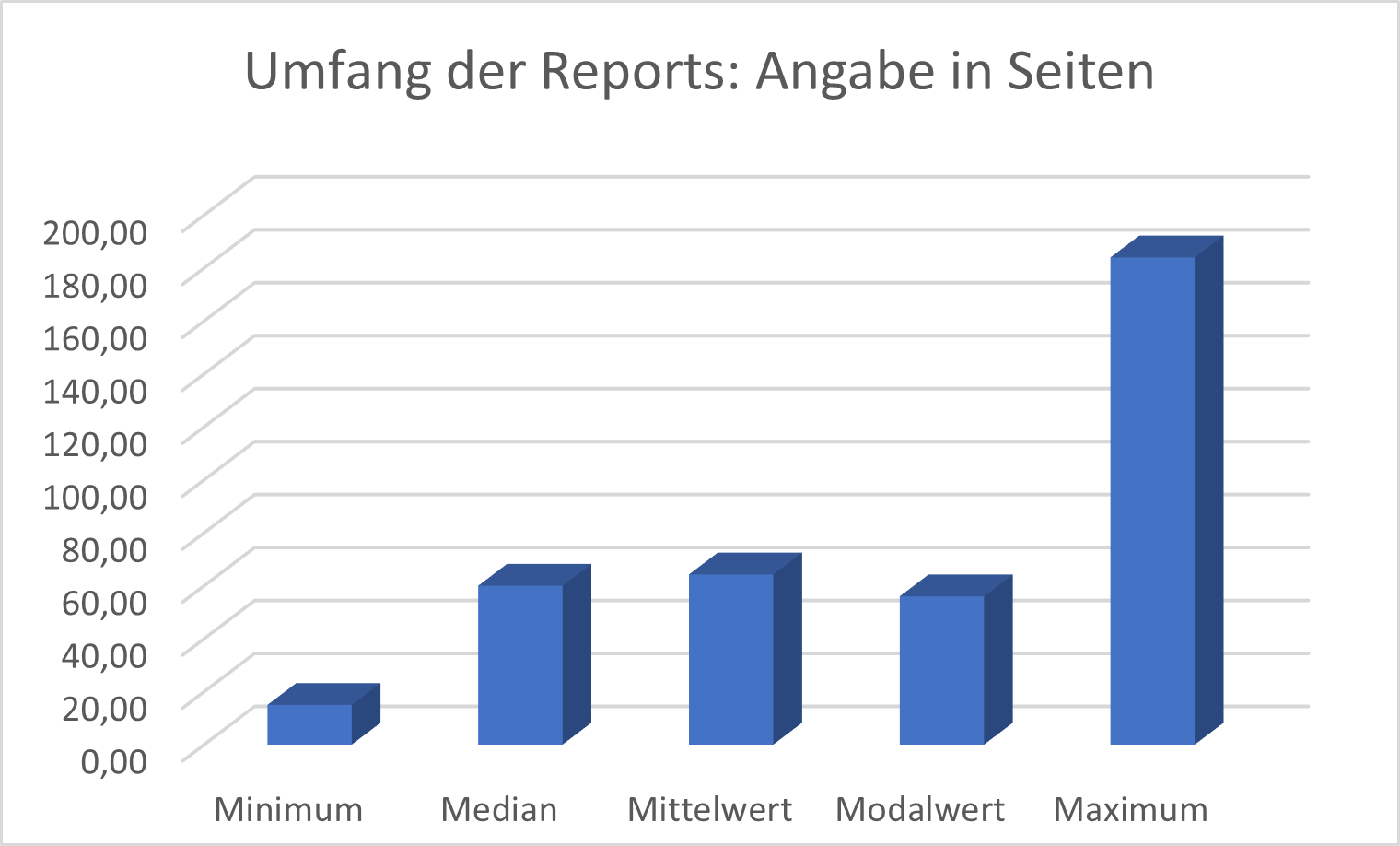

The length of the individual reports also differs greatly. The shortest report has 15 pages, while the most comprehensive has 184. On average, a report consisted of 64 pages. This does not necessarily reflect the size of the institutions. The longest report came from a Landesbank, while that of a major private bank was in the middle of the field at 70 pages. Further details can be found in the chart below.

Data basis

Since not all institutes have prepared a report on a regular basis, the reports from 2022 and 2021 are considered below. This is to ensure that the data is comparable. For this reason, the year 2019 was not included. In this year, different circumstances prevailed compared to the reporting years due to the Covid-19 pandemic. This leaves 39 banks, with 10% from the private sector, 20% from the cooperative sector and 69% from the public sector (savings banks, Landesbanken, state development banks).

Current status

The Code includes the following key figures:

| Criterion | Number of banks that have provided an indication |

| Other greenhouse gas emissions | 19 |

| Indirect greenhouse gas emissions | 22 |

| Direct greenhouse gas emissions | 23 |

| Paper consumption | 25 |

| Water consumption | 25 |

| Total energy consumption | 27 |

| Accrued waste | 27 |

As can be seen from the table, not all 39 banks provided information on every item.

It can be seen from the individual indicators that many banks are already acting sustainably and are making efforts to eliminate negative environmental impacts. Overall, the picture is relatively homogeneous for all of them, with some banks standing out as individual outliers. There appears to be potential here that can be exploited by the banks concerned.

Furthermore, the values determined are independent of the number of employees. For example, the largest bank in terms of employees has the lowest paper consumption per capita, while the significantly highest value comes from a smaller bank in terms of employees.

As can be seen from the table, 23 banks reported on how high their direct greenhouse gas emissions are. This means that 16 banks were unable or unwilling to state anything about this key variable. As the ECB, as the highest European supervisory authority, is urging that the business of the supervised banks continues to be oriented toward sustainability, such key figures will be in greater demand and subject to more critical scrutiny in the future.

Conclusion

Many but not yet all banks apply the German Sustainability Code. The topic is handled differently by the individual institutions. While there are banks that publish a report on a regular basis, for others only older reports are available.

Although the German Sustainability Code aims to create a uniform reporting standard, the respective reports currently differ greatly. This is reflected on the one hand in their scope, and on the other hand in the fact that not all banks have specified something for each criterion.

The topic of sustainability has arrived in the banking industry. A large proportion of banks are making efforts to reduce their own ecological footprint. Nevertheless, there are banks that have not yet exhausted their potential here.

As the ECB attaches importance to the banks it supervises acting sustainably, reports in the sense of the GSC will become more significant in the future.

About the author: Karl Eugen Reis has been a consultant at CURENTIS AG since 2021 and has extensive project experience in the area of financial services and anti-financial crime. In addition to these activities, he has participated as an assistant in a number of projects in auditing, including an Asset Quality Review (AQR) in preparation for the European Central Bank's bank stress test.

About the author: Karl Eugen Reis has been a consultant at CURENTIS AG since 2021 and has extensive project experience in the area of financial services and anti-financial crime. In addition to these activities, he has participated as an assistant in a number of projects in auditing, including an Asset Quality Review (AQR) in preparation for the European Central Bank's bank stress test.

About the author: Karl Eugen Reis has been a consultant at CURENTIS AG since 2021 and has extensive project experience in the area of financial services and anti-financial crime. In addition to these activities, he has participated as an assistant in a number of projects in auditing, including an Asset Quality Review (AQR) in preparation for the European Central Bank's bank stress test.