The Financial Crime Control Act (FKBG): Measures and objectives

On December 6, 2023, the Federal Ministry of Finance published the draft of the Financial Crime Prevention Act (FKBG) with the primary aim of stepping up efforts to combat financial crime and money laundering in Germany.

The FKBG is the response to the FATF's Mutual Evaluation Report, the result of which was published in 2022 and takes a critical look at the executive and judicial branches of government with regard to combating money laundering.

Criticism of the FATF 2022 Mutual Evaluation Report

Specifically, the FATF 2022 Mutual Evaluation Report criticizes the German fight against money laundering with regard to the following points:

- Germany lacks the resources in terms of technology and personnel to be able to track complex cases of money laundering offenses step by step. According to the report, the executive in Germany would not be able to react proactively to trends and complicated case constellations with the current legal options and procedures.

As a result, money launderers can often no longer be prosecuted because investigations take too long or cannot be carried out thoroughly enough due to complex structures. The FIU Annual Report 2022 confirms this criticism. According to FIU records, there were a total of 337,186 suspicious activity reports in Germany in 2022. Of these, only 51,700 were passed on by the FIU to the investigating authorities for further investigation. This corresponds to a total share of 15.3%.

- A second point of criticism from the FATF is the communication between the authorities in Germany. Here, the FATF reveals that the prevention of money laundering is prioritized differently by the various competent German authorities. According to the FATF, the different views on the topic of money laundering result in chaos between the authorities. There needs to be a general, clear understanding of money laundering and the predicate offenses so that the authorities can work together more effectively in the future. Although Germany uses many resources to prosecute and punish the predicate offenses that underlie money laundering, it prosecutes money laundering much less consistently and effectively. As a result, ongoing investigations are no longer properly traceable and the laundered money has long since been redistributed by the money launderers. According to the FATF, Germany takes a reactive rather than a necessary proactive approach here.

- The FATF also criticizes the area of Designated Non-Financial Businesses and Professions (DNFBPs) and non-bank financial institutions in particular. Germany has major monitoring deficiencies in this area. DNFBPs are companies such as real estate agents, dealers in precious metals or gemstones and dealers in saleable items with a value of EUR 15,000 or more, as well as lawyers, notaries and other self-employed lawyers or auditors. Germany has a very low level of reporting awareness in this area. Although DNFBPs are legally obliged to report suspicious cases to the FIU, in reality this does not take place to a sufficient extent. In addition, companies are audited far too infrequently to raise awareness of the need to report. The FIU annual report underlines the lack of awareness of anti-money laundering in the non-financial sector with its figures: Suspected money laundering reports from the non-financial sector account for only 3.3% of the total reports filed in 2022. This figure seems even more remarkable when you consider that the National Risk Analysis from 2022 attests a medium-high money laundering risk to real estate agents and capital management companies, which are part of the non-financial sector. The DNFPB sector is a lucrative area for money laundering, especially due to the cash affinity of Germans. According to the consumer advice center, 58% of all transactions in Germany are carried out with cash. Cash transactions are much more difficult to trace than bank transfers. Transactions involving luxury goods in particular are very easy to disguise with cash and make the origin of the money unrecognizable. The FIU's annual report has also published figures on this. Of the 337,186 suspicious activity reports in 2022, only 10,096 were from the non-financial sector, i.e. from DNFBPs.

- The FATF report also criticizes the uneven distribution of financial supervisory audits in relation to the various obligated parties under the AMLA. In Germany, banks and financial companies are audited significantly more often and more closely than companies from the non-financial sector, such as notaries and real estate agents. This results in a lack of awareness of the implementation of the legal framework among companies in the non-financial sector. Above all, there is a lack of awareness of functioning risk management and the correct implementation of due diligence obligations when dealing with customers. According to the national risk analysis, transactions involving real estate are particularly susceptible to money laundering. In the context of share deals and nested company structures, particularly in conjunction with so-called letterbox companies from abroad, de facto anonymity can be created in real estate sales.

Due to the shortcomings mentioned, the FATF sees great potential for improvement in Germany. This potential is to be exploited by the FKBG and the new authorities it creates. The Financial Crime Prevention Act (FKBG) was presented as a draft bill in the Bundestag on October 11, 2023 and was last discussed in various committees in January 2024.

The Financial Crime Prevention Act in the form of the draft bill is intended to close the gaps between the FATF report and the current situation in Germany. Accordingly, the draft is divided into several technical areas. Each area deals with a specific aspect of the fight against financial crime.

The FKBG contains a number of measures to combat money laundering more effectively in Germany. One central measure is the creation of a Federal Office for Combating Financial Crime (BBF) with a Money Laundering Investigation Center (EZG). The aim of this is to ensure that reports of suspected money laundering by obliged entities under the AMLA can be processed and prosecuted more quickly and thoroughly.

In addition, the cooperation between the Financial Intelligence Unit and other players in the fight against money laundering is to be further improved. The players in the fight against money laundering include the banks and other obligated parties under the Money Laundering Act. The FKBG would therefore make the BBF, alongside BaFin, the central office for information and investigations for obliged entities.

In addition, a new real estate transaction register is to be established in order to create more transparency in the real estate sector. There are also plans to expand the group of obliged entities to include financial holding companies and mixed financial holding companies.

Draft bill of the Financial Crime Prevention Act in Germany

The first part of the draft law deals with the establishment of the Federal Office for Combating Financial Crime (BBF). The draft law sets out the organizational structure of the office and defines its main tasks and powers. The BBF is to act as the central authority for combating financial crime and bring together analysis and criminal investigations as well as the coordination of money laundering supervision.

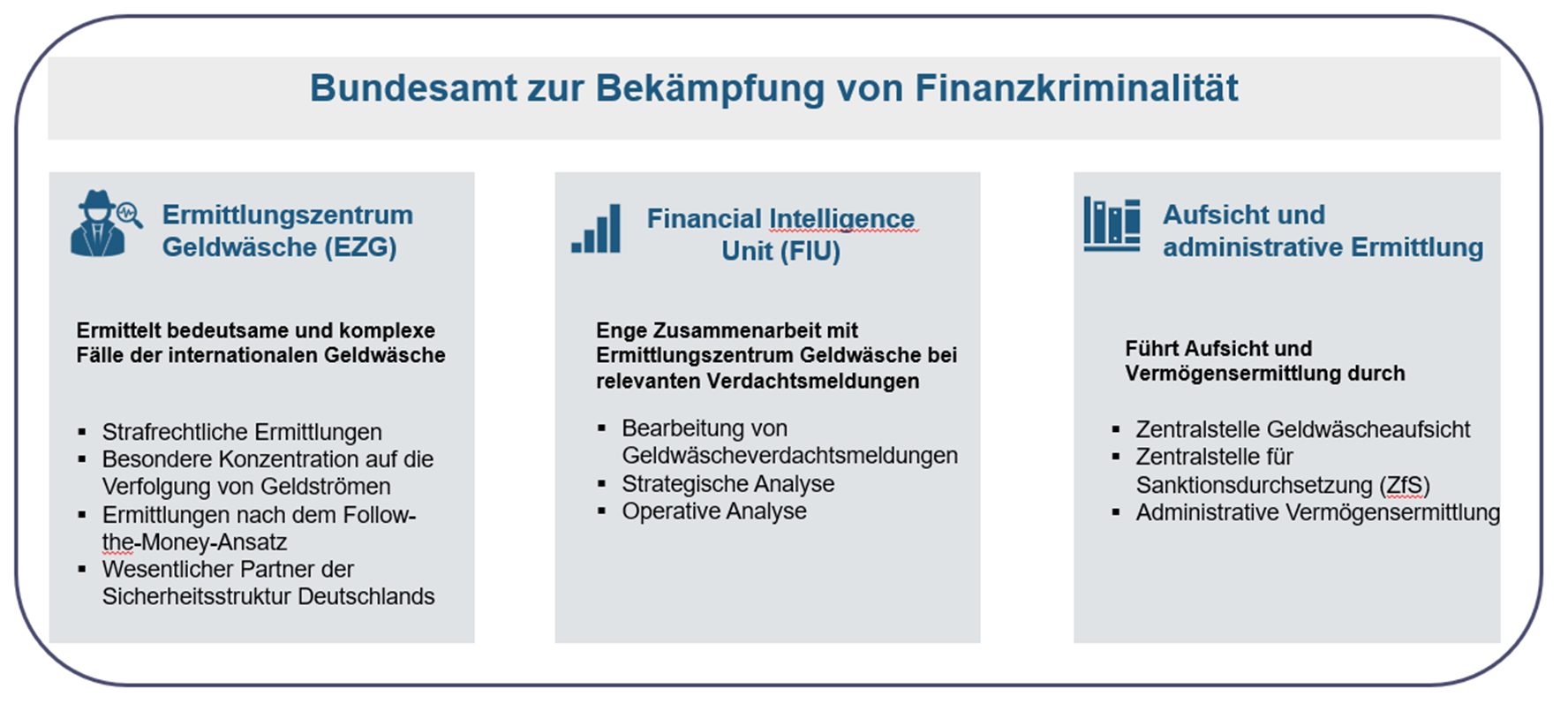

The Federal Office for Combating Financial Crime is to consist of three pillars:

Source: Own representation

The first pillar will be the new Money Laundering Investigation Center (EZG) (previously known as the Federal Financial Crime Office (BFKA)). The investigation center will investigate significant international cases of money laundering with a connection to Germany and will proceed differently than other law enforcement agencies. From now on, the investigation center will use the "follow-the-money" approach. The EZG will not investigate on the basis of the predicate offenses, but will start with the suspicious financial flows in order to identify the money launderers and uncover any predicate offenses or acts in connection with money laundering. This enables a special concentration of capacities for the prosecution of money flows in connection with the money laundering offense. Suspicious transactions, with or without predicate offenses, are to be analyzed comprehensively and processed promptly. The FCA can investigate independently of other investigative units and thus exclusively pursue the offense of money laundering without having to rely on the capacities of other authorities. With this approach, the FCA aims to prevent the passivity in money laundering investigations criticized by the FATF. Through the "follow the money" approach, the Ministry of Finance hopes to achieve a better investigation rate in larger and more complex money laundering cases. In addition to existing structures, the Money Laundering Investigation Center will act as a key partner in Germany's security architecture and can cooperate with other federal and state law enforcement agencies by forming joint investigation teams in large-scale cases.

The Financial Intelligence Unit (FIU) is to form the second pillar of the BBF. The FIU in Germany is currently an independent Directorate X of the General Customs Directorate (GZD) and is responsible for processing suspected money laundering reports. It receives the suspicious activity reports on money laundering submitted by obliged entities via the GoAML reporting portal, analyzes these reports and forwards them to the competent authorities for prosecution. In its function as FIU in Germany, Directorate X has limited resources to process the SARs. The transfer of the FIU to the BBF will free up new resources that can be used to process SARs more quickly and effectively. The FIU's areas of responsibility will be redefined. The FIU's areas of responsibility within the BBF are to be changed in comparison to Directorate X in the Directorate General of Customs. The FIU is to process suspicious activity reports according to a risk-based approach. This means that resources can be pooled in certain, particularly serious cases in order to achieve a faster result in the investigation. Within this risk-based approach, the FIU is to be given more decision-making leeway so that it can allocate resources itself depending on the workload and urgency of the incoming reports. The Ministry of Finance hopes that this restructuring, the resulting new resources and the increased flexibility within the FIU due to the risk-based approach will lead to more effective processing of suspicious activity reports.

The third pillar within the Federal Office for Combating Financial Crime will be the Central Office for Sanction Enforcement. Like the Money Laundering Investigation Center, this central office is a unit established by the FKBG. This unit currently exists in a smaller form as Directorate XI in the Directorate General of Customs. Like the EZG, it is to be transferred from customs to the BBF. Within the central office, the enforcement of the regulations from the Sanctions Enforcement Act (SanktGD) will be monitored and the reports to be submitted by market participants regarding sanctions violations will be processed. The transfer from customs to the Federal Office will free up new resources for the Central Office for Sanctions Enforcement.

The second part of the draft law deals with the regulation for the establishment of a real estate transaction register. The real estate transaction register is a central database that was introduced as part of the Financial Crime Control Act. It enables the authorities to access up-to-date real estate data. The register is intended to contain information on all real estate transactions where the purchase price exceeds 20,000. Since the introduction of the FKBG, notaries and courts are therefore obliged to transmit data on real estate transactions to the register in accordance with Section 15 of the AMLA. The register will help to bring transparency to the real estate market and reduce the opportunities for money laundering through real estate transactions.

In addition, more companies from the non-financial sector are to be audited more regularly with the increased number of employees in order to be able to take more successful action against money laundering in the non-financial sector.

Through the transfers, the new distribution of resources and the new procedures for investigations within the Federal Office for Combating Financial Crime, the Ministry of Finance hopes to create a new competent authority within the German judicial system with regard to combating money laundering

The official set-up phase of the BBF is scheduled to begin in 2024. The authority should then become fully functional in 2026. Until then, the law still has to be discussed in the specialist committees of the Bundestag. It therefore remains to be seen when the draft from October 2023 will be implemented. The project kick-off for the conception and establishment of the BBF project took place in December 2022. It brought together representatives from a wide range of areas, including public prosecutors, judges, investigators, ministry officials, forensic experts, anti-money laundering supervisors and psychologists, in order to completely reorganize the fight against money laundering in Germany.

The draft law shows that the Federal Government has understood the relevance of the issues of financial crime and money laundering and is willing to implement measures in the form of new capacities and procedures.

CURENTIS assessment of implementation

The points of criticism raised in the 2021 FATF review in Germany include Germany's vulnerability to money laundering and terrorist financing, as well as the insufficient effectiveness of the German anti-money laundering system. In particular, the inability of the anti-money laundering system to adequately detect and prosecute complex money laundering offenses was highlighted. More capacity in the form of staff and new authorities with new areas of responsibility will do little to change this fundamental problem if the relevant know-how and procedures for tracking money flows and assets are not in place. The "follow the money" approach in the FCA, if applied correctly, can lead to greater success in identifying money launderers. To achieve this, the procedures and knowledge of money laundering must be transferred to a broad range of officials. It remains questionable whether it will be possible to build up the necessary expertise among a sufficient number of employees.

A much more effective method of combating money laundering is the preventive measures taken by obliged entities in accordance with the Money Laundering Act. The FIU report shows the need for improvements in the non-financial sector in this area. The BBF, or at this stage the BaFin, have the opportunity to create a widespread awareness of preventive security measures against money laundering through increased audits in the non-financial sector and thus make it more difficult for money launderers in Germany to decriminalize their money. These audits can lead to effective preventive measures in the non-financial sector within a short period of time.

In contrast, restructuring along the lines of the FKBG will take several years. The Ministry of Finance has not published a statement on how the executive in Germany will be structured in the transition phase between 2024 and 2026, i.e. the functional start of the BBF. It is therefore possible that capacities could be used even more ineffectively or not used at all during this period. This would increase the scope for money launderers in Germany. It also remains to be seen whether the BBF will really be able to work effectively in 2026. Restructurings of this size are difficult in Germany and can impair the smooth running of ongoing investigations.

On January 29, the Bundestag met for the first time in 2024 to discuss the FKBG and a related motion by the CDU/CSU parliamentary group on financial crime with the Finance Committee. The experts' votes on the current draft bill remain controversial and it remains to be seen to what extent the demands will be implemented in the Bundestag. The German Police Union (GdP) rejects a new structure for the authorities. "In the view of the GdP, the intended establishment of a new federal authority, the Federal Office for Combating Financial Crime (BBF), outside the existing police structures of the Federal Criminal Police Office, customs, federal and state police does not improve or optimize existing processes and laws, especially in the fight against complex financial crime," said the chairman of the GDP in the Bundestag session.

The issues of financial crime and combating money laundering will continue to occupy Germany in the coming years. Initiatives such as the FKBG show that the German government is willing to do more to combat financial crime and money laundering. It remains to be seen whether the Financial Crime Prevention Act and the changes it seeks to make are the right ones to better protect Germany from financial crime and money laundering.

In any case, the next few years will also increasingly depend on the obligated parties under the Money Laundering Act. The more effective the preventive measures against money laundering in the financial and non-financial sector are, the better Germany will be protected against money launderers.