Suspicious money laundering reports at record level: reporting volume doubled in 2021

On September 21, the Financial Intelligence Unit (FIU) published its 2021 annual report. With a view to the volume of reports, we have summarized the most important knowledge for you below:

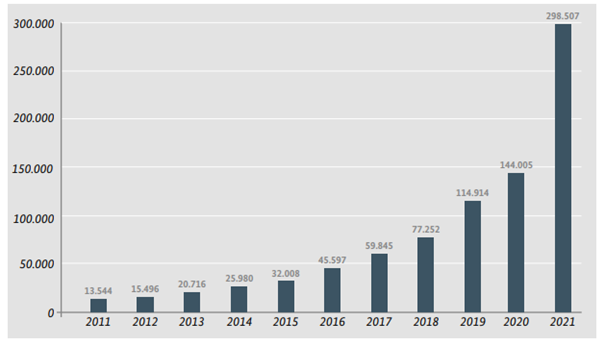

The Financial Intelligence Unit (FIU) is the national central office for financial transaction investigations and is thus responsible for receiving, collecting and analyzing SARs under the Money Laundering Act (AMLA). The following chart shows how the number of SARs has developed over the past ten years.

Development of the number of SARs under the AMLA (2011-2021) (Source: Annual Report 2021, FIU)

It quickly becomes clear that the number of incoming SARs, which had already grown dynamically in previous years, skyrocketed even more in the 2021 reporting year. With a total of 298,507 SARs, the number more than doubled compared to the previous year. This was mainly due to two events that took place around 2021: firstly, the AMLA Reporting Ordinance (GwGMeldV-Immobilien) came into force on October 1, 2020. The new ordinance strengthens the reporting obligations of certain professionals in transactions in connection with real estate transactions and obliges notaries, lawyers, tax advisors as well as real estate agents, among others, to report conspicuous circumstances that indicate a possible connection with money laundering to the FIU. On the other hand, there was an amendment to Section 261 of the German Criminal Code (StGB), which has been in effect since spring 2021 and significantly expands the scope of money laundering offenses. While the previous version listed exactly what could constitute a predicate offense for money laundering in a selective list of predicate offenses, the new version does away with this and uses the so-called all-crime approach. According to this approach, it is no longer necessary to prove a serious crime, but rather it is sufficient if there is concealment of assets from any crime. Furthermore, the dynamic development of the crypto market played a role.

As in previous years, the increase in the volume of SARs is evident in both the financial and non-financial sectors. However, at around 97 percent, the vast majority of SARs received continue to come from the financial sector. The increase in reports submitted by payment and electronic money institutions is particularly striking. From only 238 SARs received in 2020, these rose to a total of 95,286 in 2021. This can be attributed to the adjusted behavior of individual payment and e-money institutions in response to the all-crime approach.

In the non-financial sector, the number of SARs almost tripled compared to the previous year (2020: 0.7%; 2021: 2.7%). This disproportionate increase is primarily due to the entry into force of the AMLA Real Estate and the associated increase in the number of reports from the group of notaries.

In addition, almost 3,400 new registrations took place in 2021. This brings the total number of obligated parties registered with the FIU to just under 16,000 at the end of 2021 (2020: 12,600 registered).

Pandemic exploited for further fraud crimes

As in the previous year, the pandemic also had an impact on the figures for the 2021 reporting year. It should be noted that the number of received SARs related to COVID-19 decreased significantly to approximately 3,400 (2020: 11,200 SARs). The main reason for the sharp decline in SARs is the tightening of verification requirements for recipients of government subsidies, such as bridging assistance. This was a consequence of the numerous Corona emergency aid fraud cases in the previous year. Nevertheless, criminals knew how to capitalize on the pandemic using other methods. For example, numerous SARs were received related to billing fraud crimes via Corona testing stations. Some companies opened testing centers for free citizen testing. In the absence of effective controls on actual testing at the outset, some saw an opportunity to extract large profits from the test centers. This led to misrepresentations in the billings, to the detriment of the health care system. According to the FIU, this involved both individuals who had actually suffered from loss of revenue due to the pandemic and individuals who had previously attracted attention due to criminal offenses.

However, it became clear that obligated parties as well as authorities were more sensitized in the second year of the pandemic. This meant that any gaps could be closed more quickly through short-term reactions and process adjustments. The establishment of a task force also improved communication between authorities, ministries, and disbursement agencies, and helped with systematic audits of COVID-19-related fraud.

Flood relief as a new modi operandi for fraud schemes

The flood disaster that occurred in the summer of 2021 in North Rhine-Westphalia, Rhineland-Palatinate and Bavaria also showed potential for fraud, which criminals exploited. Emergency state aid was to be paid out quickly and unbureaucratically for those affected. As a result, applications were granted without extensive checks to determine whether the primary residence was actually in the flood area. The FIU conducted analyses with a view to possible unlawful emergency aid applications. These showed that applications for government relief funds were predominantly reported by persons who were not residents of the flood area. In isolated cases, these were individuals who had previous criminal convictions for unlawfully applying for Corona emergency assistance. In comparison to the Corona emergency aid reports, however, it must be said that the number of reports related to flood aid was low.

Source: Customs online - Press releases - FIU annual report 2021