Implementation of climate risks is still in its infancy at many banks

In 2022, the ECB conducted the first climate stress test, which will be conducted on an annual basis in the future. CURENTIS had already reported on the results here.

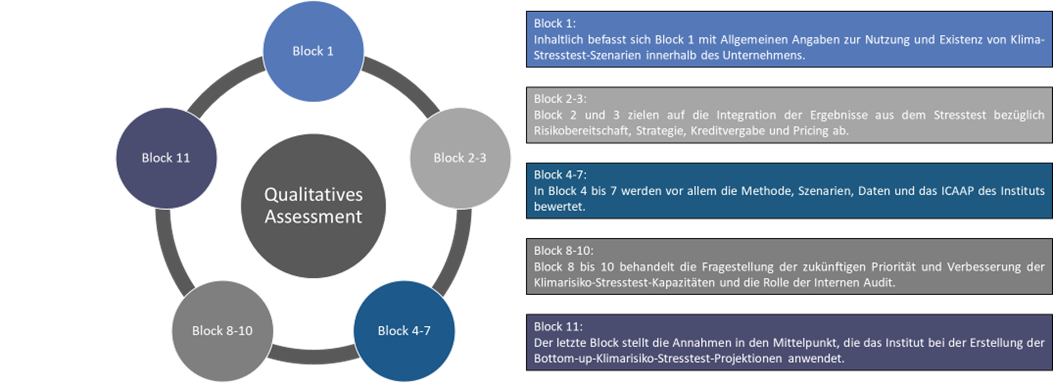

In the following part of our series of articles on the individual modules of the ECB Climate Stress Test, we present the qualitative part, which covers the topics shown in the chart.

Figure 1: Qualitative assessment

The climate stress test clearly showed that, despite some progress, banks have not yet sufficiently integrated climate risks into their internal models.

Less than half of the audited institutions (about 40%) have implemented a climate stress test framework. In particular, the ECB stress test revealed that the data situation on climate-related issues is a challenge for banks. The data problem is cited as a key obstacle to the development of a framework regarding climate stress testing.

Around 40% of banks that have implemented a climate stress test state that the results have no impact on the institution's corporate strategy. Only 19% of banks with climate stress test scenarios take the results into account in the lending process.

Overall, the results show that, at this stage, financial institutions are only assessing climate risks or incorporating them into their risk strategy to a limited extent.

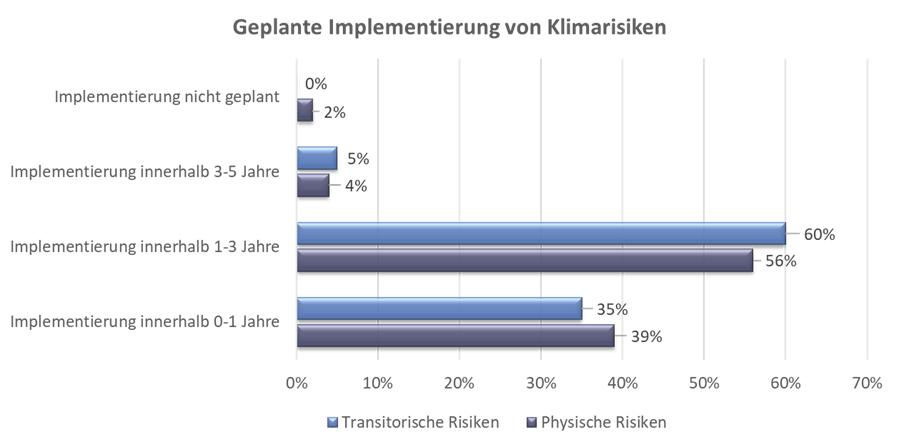

More than 50% of institutions that do not yet have a climate risk framework indicate that physical or transitory risks can only be implemented in their framework in one to three years (Figure 2).

Almost all financial institutions feel compelled to improve the data situation in order to be able to adequately consider climate risks.

Figure 2: Time horizon for implementing a climate stress testing framework[1].

The ECB Climate Stress Test 2022 clearly showed that the implementation of climate risks at financial institutions is still in its infancy. However, this offers the opportunity to seize the transformation to a sustainable economy as an opportunity through a proactive approach.

CURENTIS AG supports you in the implementation of climate risks in the risk strategy, data collection and utilization, process adaptation as well as in regulatory issues.

Source: ECB: 2022 climate risk stress test (above the whole source deposit the following link https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.climate_stress_test_report.20220708~2e3cc0999f.en.pdf)

About the author: Artur Kehrein has been a Senior Consultant at CURENTIS AG since 2022. In the course of his many years of work in financial institutions and in consulting, he has been able to build up extensive project experience. In addition, he has specialized in regulatory reporting and sustainable finance.

[1] Own presentation based on ECB 2022 climate risk stress test, https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.climate_stress_test_report.20220708~2e3cc0999f.en.pdf.