KYC process for cryptocurrencies

KYC for cryptocurrencies

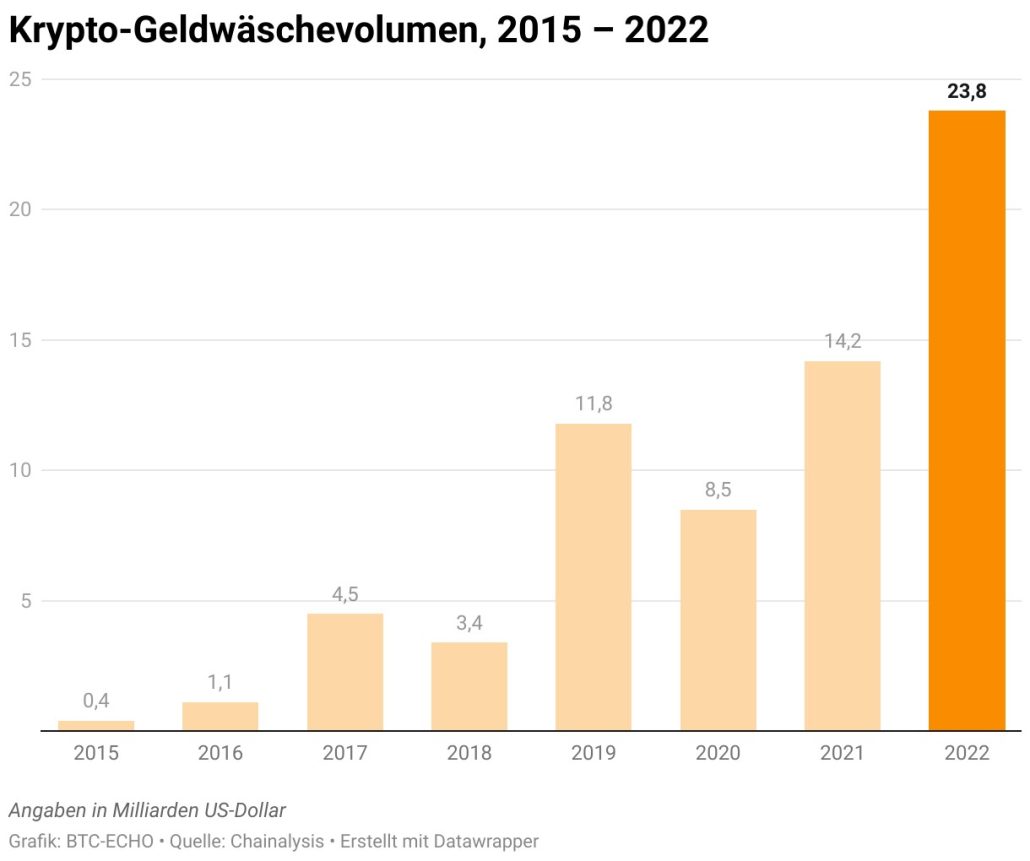

A report by blockchain analytics firm Chainalysis shows that crypto money laundering increased significantly in 2022[i]. Cybercriminals attempted to transfer nearly $24 billion into the legal economy through cryptocurrencies, a 68 percent increase from the previous year. Although the use of so-called crypto-mixers, where funds from different users are mixed together to make tracking more difficult, has decreased. In 2021, $11.5 billion was still transferred to these service providers, compared to just $7.8 billion in 2022.

Despite the increase in the volume of money laundering in the crypto sector in 2022, cybercriminals were also affected due to the market turmoil of the previous year. In particular, hackers who held rather than transferred their loot to the legal economy suffered heavy losses. The total value of captured cryptocurrencies was $12 billion in 2021, while it was only $2.9 billion a year later. Government seizures exacerbated the decline, Chainalysis reports.

What is the reason for this?

Regulation of cryptocurrencies

On June 21, 2019, virtual assets were added by the Financial Action Task Force (FATF) to its list of key issues and threats to the integrity of the financial system. On that day, the FATF issued a public statement on virtual assets and related providers (FATF 2019a) and later published its first guidance on a risk-based approach to dealing with virtual assets and service providers (FATF 2019b). This guidance was updated in October 2021 (FATF 2021b) after two annual revisions.

The European Union has agreed on uniform rules to curb money laundering in the crypto market. The rules are in line with the strictest international standards for cryptocurrency trading, in particular Recommendations 15 and 16 of the FATF, the global watchdog for money laundering and terrorist financing. In the future, digital currencies will only be allowed to be sold in the EU by companies that can demonstrate certain licenses and customer protection measures.

As part of the implementation of the fifth European Money Laundering Directive (AMLD5), the German BaFin finally recognized cryptocurrencies as a means of payment in 2019. As a result, cryptocurrencies were immediately regulated as part of the German Payment Supervision Act (ZAG) or the German Banking Act (KWG), depending on their form of use. This means that companies that offer trading in cryptocurrencies are also subject to the requirements of the Money Laundering Act (GwG). This includes the structured execution of the KYC process (Know Your Customer), the monitoring of transactions and the reporting to supervisory authorities.

The basics of KYC compliance for cryptocurrencies (onboarding process).

Cryptocurrency compliance is the process of meeting the various requirements set forth in the cryptocurrency anti-money laundering regulations by implementing appropriate internal tools and processes to effectively combat money laundering and terrorist financing.

The steps to KYC compliance include gathering information about the person or company with whom one wishes to do business, such as name, address, date of birth, utility bills, and financial experience. For companies, identifying the beneficial owner is especially essential. The information collected must be analyzed and evaluated based on risk. In addition, the audit steps must be documented.

It remains to be seen whether the AML requirements will be sufficient to sustainably reduce crypto money laundering or whether hacks in particular will further increase crypto money laundering volumes.

[i] https://www.btc-echo.de/news/krypto-geldwaesche-und-hacks-waren-2022-so-hoch-wie-noch-nie-158793/